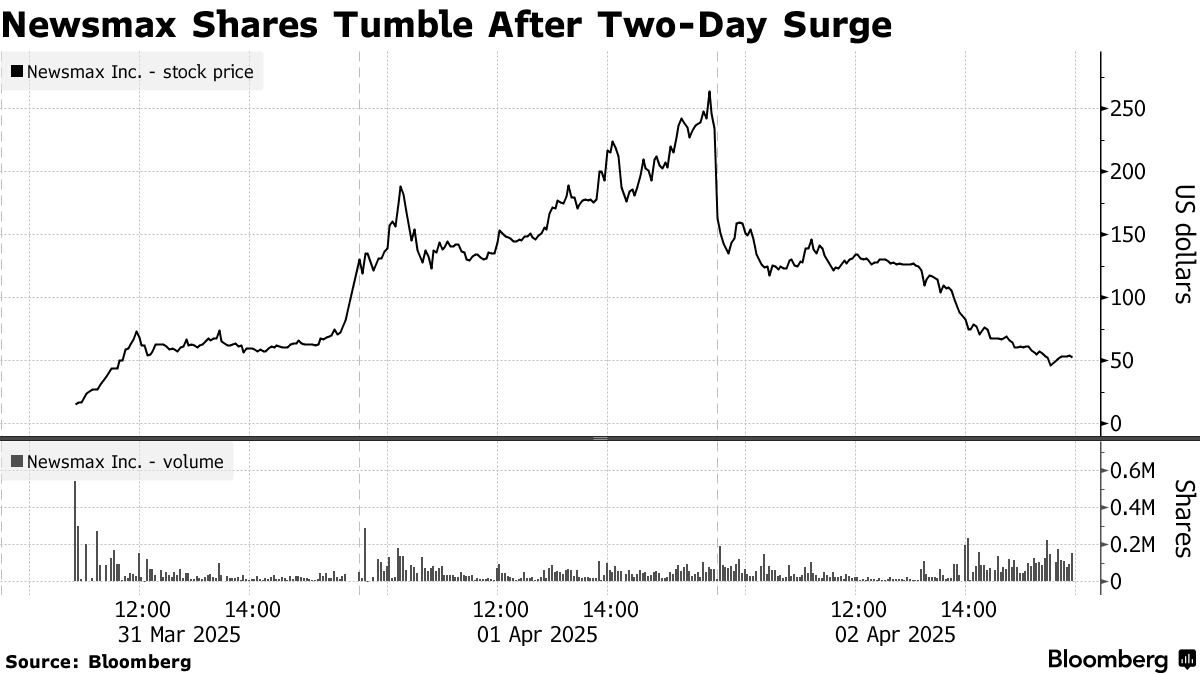

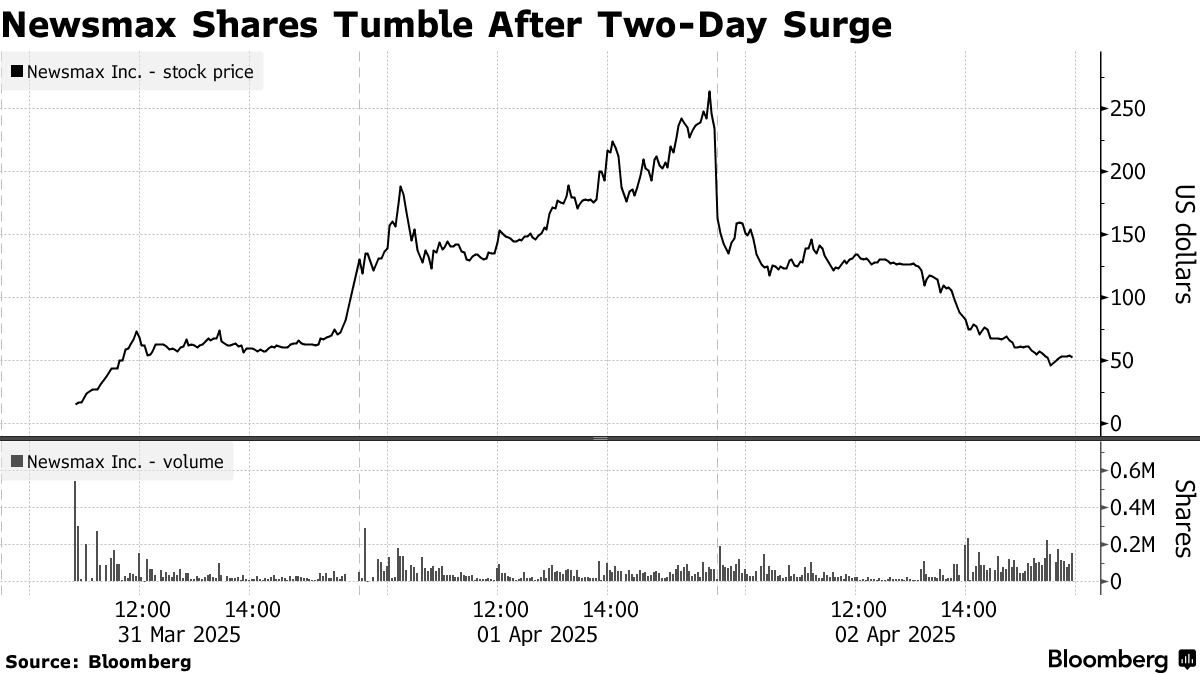

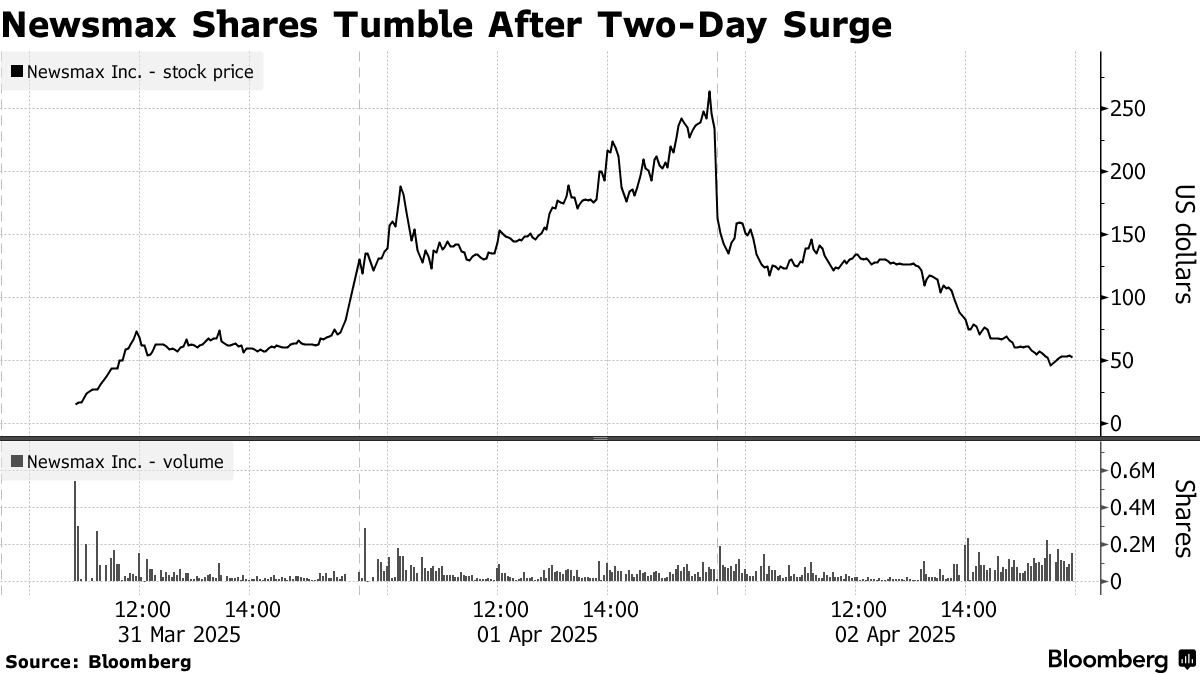

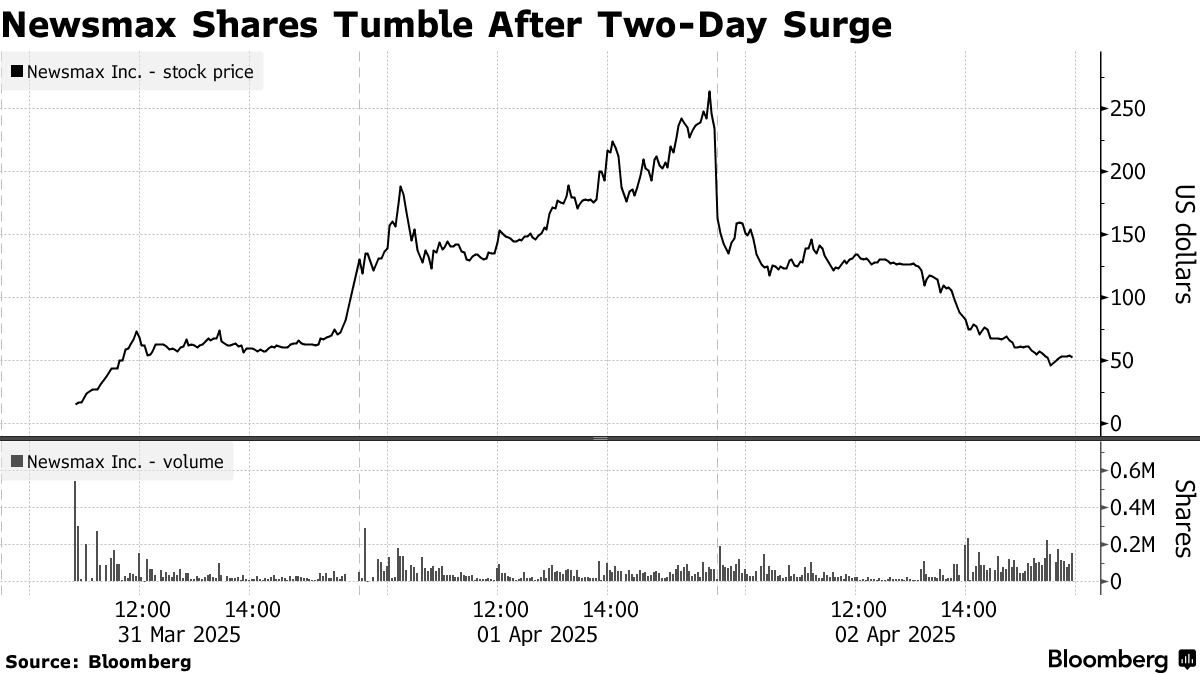

A loss of $72.2 million in 2024, with only $171 million in revenue: doesn’t seem too attractive, does it? On top of that, Newsmax faces a defamation lawsuit fromDominion Voting Systems, with a jury trial scheduled for mid-2025 (Reuters, 2025).

So why all the hype? Surely it seems like a bad investment with bad financials and a bad reputation? It makes you wonder what investors see. Well, I believe it’s a tale as old as time: a meme stock phenomenon. Just like the GameStop saga in 2020, retail investors are moving markets and having their say .

Both stocks experienced significant volatility and retail investor involvement. However, the factors influencing the early surges are completely different.GameStop's stock price skyrocketed due to a short squeeze driven by retail investors coordinating on social media platforms like Reddit (The Guardian, 2025).

This is not the case for Newsmax, though; the influence of Donald Trump may have played a big part in driving the demand for this stock. For a while now, the network has supported his political agenda and been rewarded for it. He has repeatedlypraised Newsmax saying that the company is "going up like a rocket ship" after itsurpassed CNN in the prime-time viewership rankings.

We can see that unlike GameStop’s performance, which had very few ties to politics, Newsmax's stock surge has been attributed to conservative retail investor enthusiasm. This is a small but crucial factor to pick up on, as Trump’s fans have largely been involved.

Overall, Newsmax's IPO and recent stock performance highlights how hype driven retail investors can still shape today’s markets. Reminiscent of the 2020 GameStop saga, the company has been making headlines and tempting speculators with some of the most dramatic price movements seen from a fresh IPO.

Everyone is questioning whether or not Newsmax has real underlying value. I’m hereto tell you it doesn’t. Despite being a popular conservative news channel, with the backing of Donald Trump, there is simply not enough evidence of real value. There is, however, more than enough evidence of problems. The company faces multiple lawsuits awaiting trial, as well as financial challenges with operating losses throughout 2024. The hype, popularity and speculation around the stock adds to the company’s troubles - it’s too volatile. This combination of problems makes it obvious to me that Newsmax is not a stock with underlying value. It’s been overbought, and we will see that reflected in future, downward, price action.