From a technical perspective the outlook for gold is fundamentally range bound, and traders keep lifting offers at the $3,280-$3,300 handles, but haven't made a strong break above $3,500. The RSI indicates that we are nearing overbought levels, despite increased inflows into gold ETFs. This suggests short term exhaustion with the bullish trend. Offers keep getting hit at the top of the range, but a lack of follow-through implies the smart money has already rotated out.

Both silver and platinum are increasing in popularity as inflation hedges and industrial demand plays. The metals are increasingly catching bids and are outperforming gold YTD. This may be a structural shift, as investors look for relative value, and right now gold's stretched multiple is beginning to look rich.

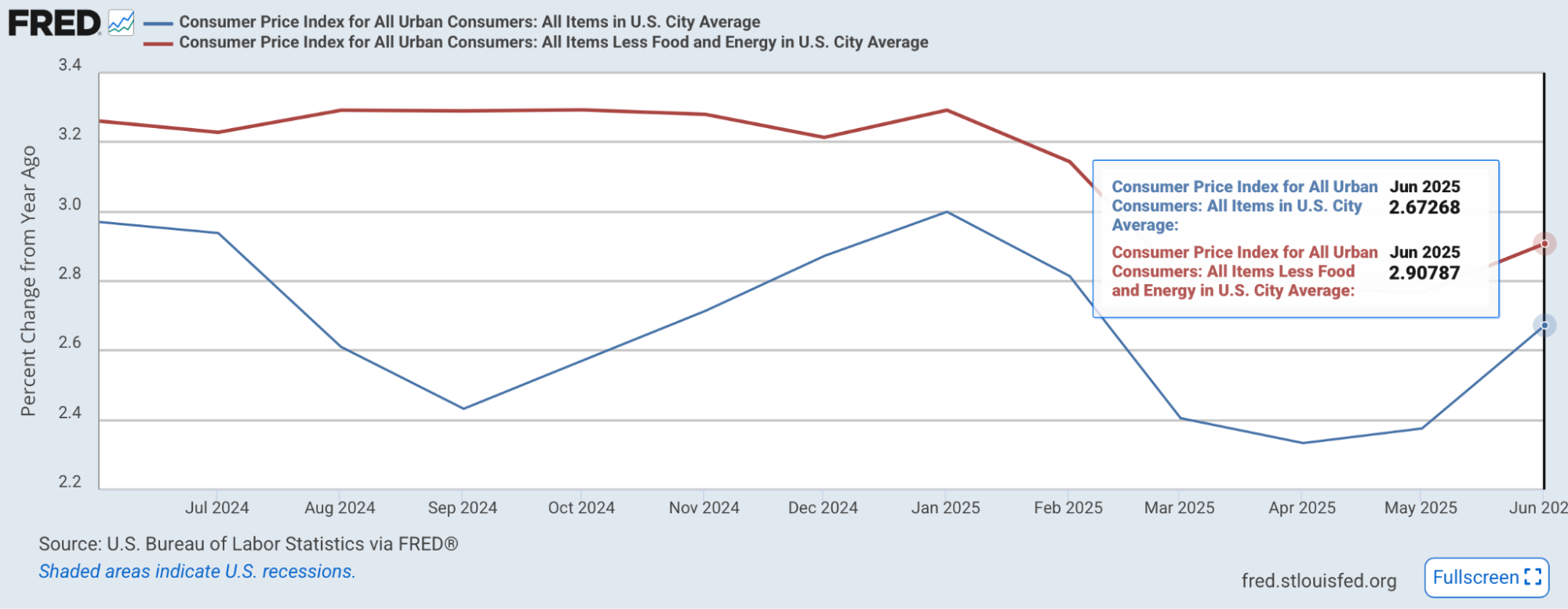

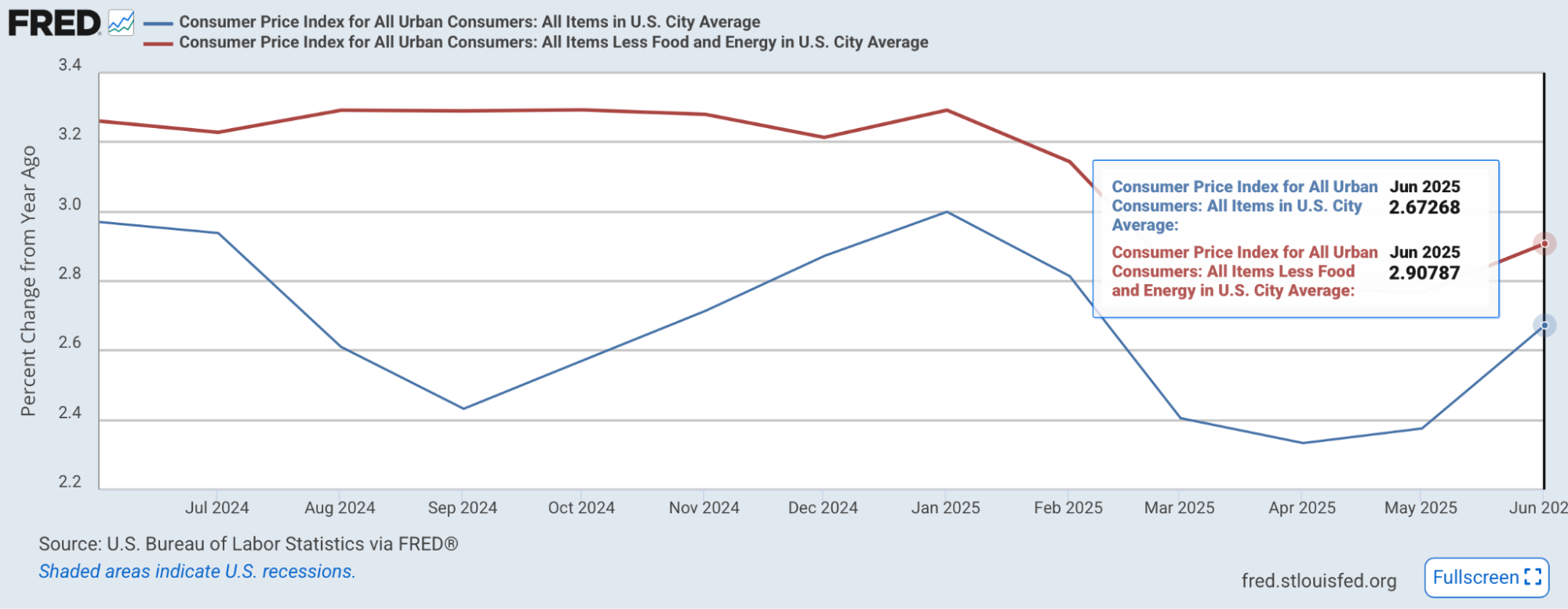

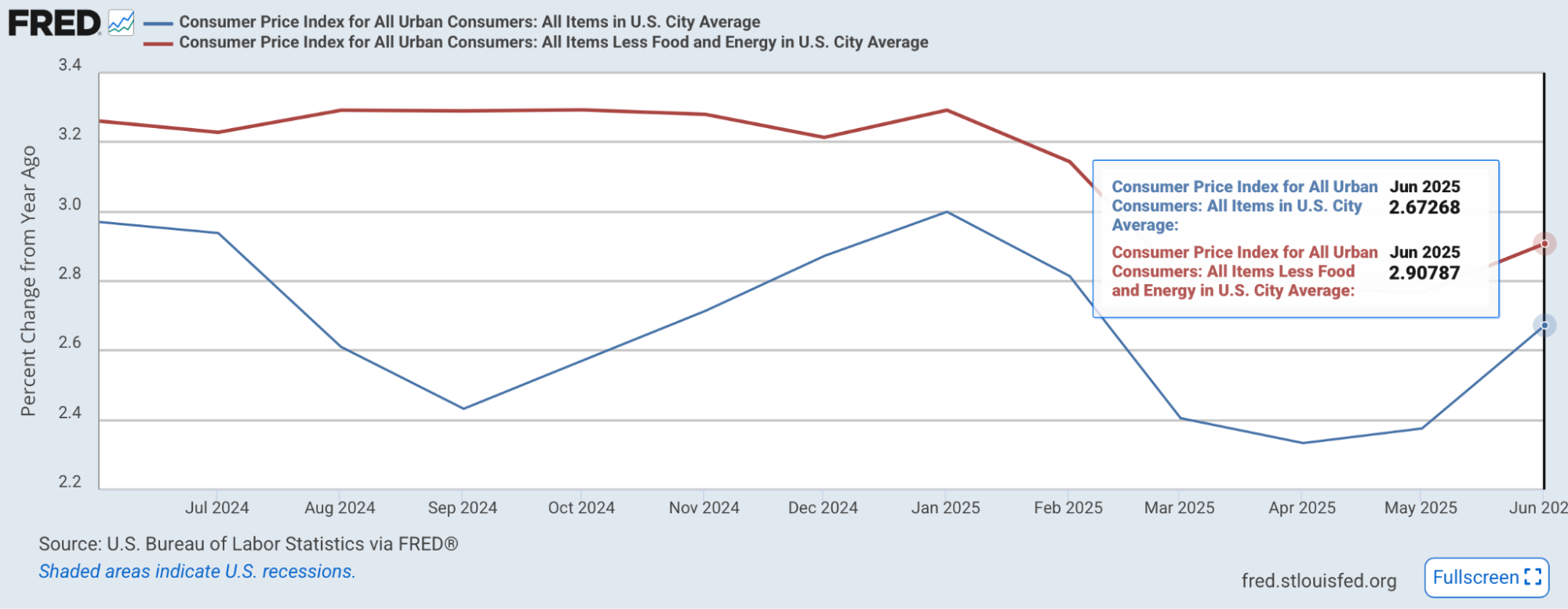

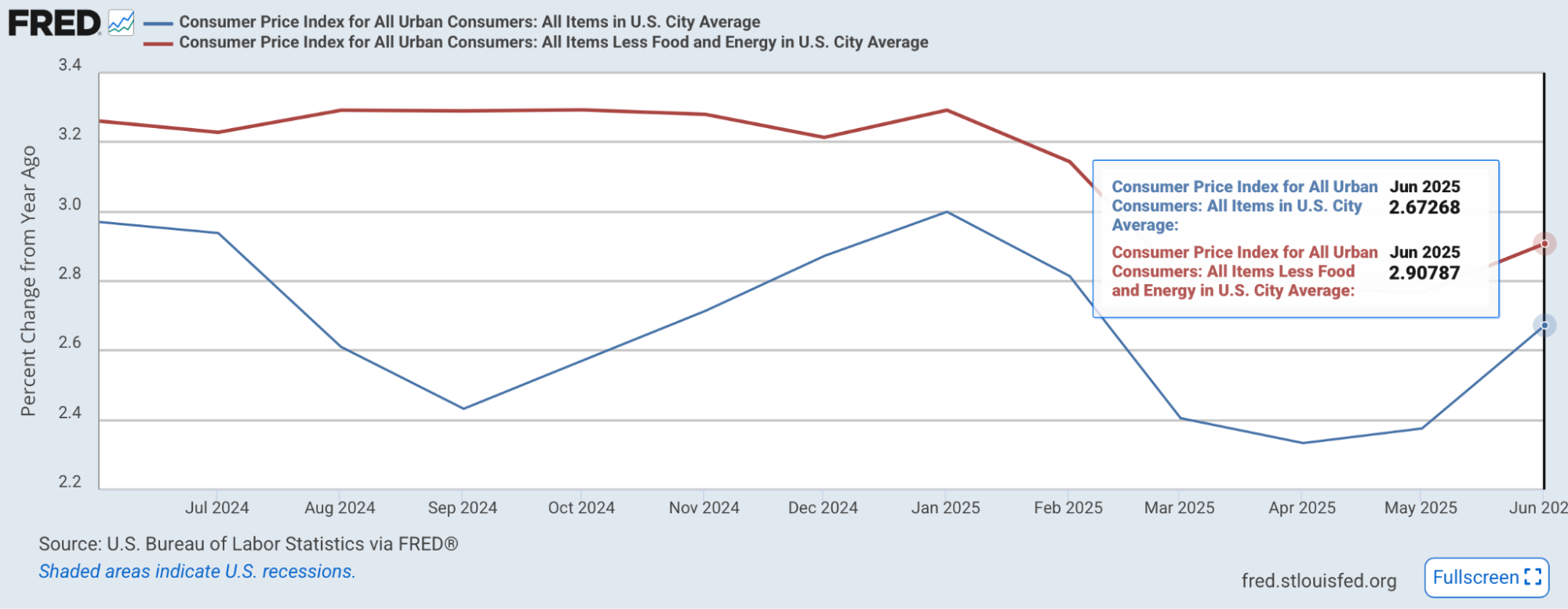

Undoubtedly, one of the most important factors offering resistance for gold are the FED’s outlook on inflation. Now, we know that Powell has been under heavy scrutiny from the likes of Donald Trump with his approach in achieving the dual mandate; however, from my perspective, Powell’s ‘Higher for Longer’ approach reflects his prudent nature to not cut prematurely and to avoid another inflation spiral. Let's have a look at inflation:

At 2.67%, headline inflation is still 0.67% above the FED’s 2% target, with core inflation still proving a significant problem for the FED due to wage growth, increasing the business costs which are later passed on to consumers. Therefore, cutting rates now could reignite demand by boosting business and consumer spending, increasing the demand for goods and services, and may risk initiating another wave of inflation.

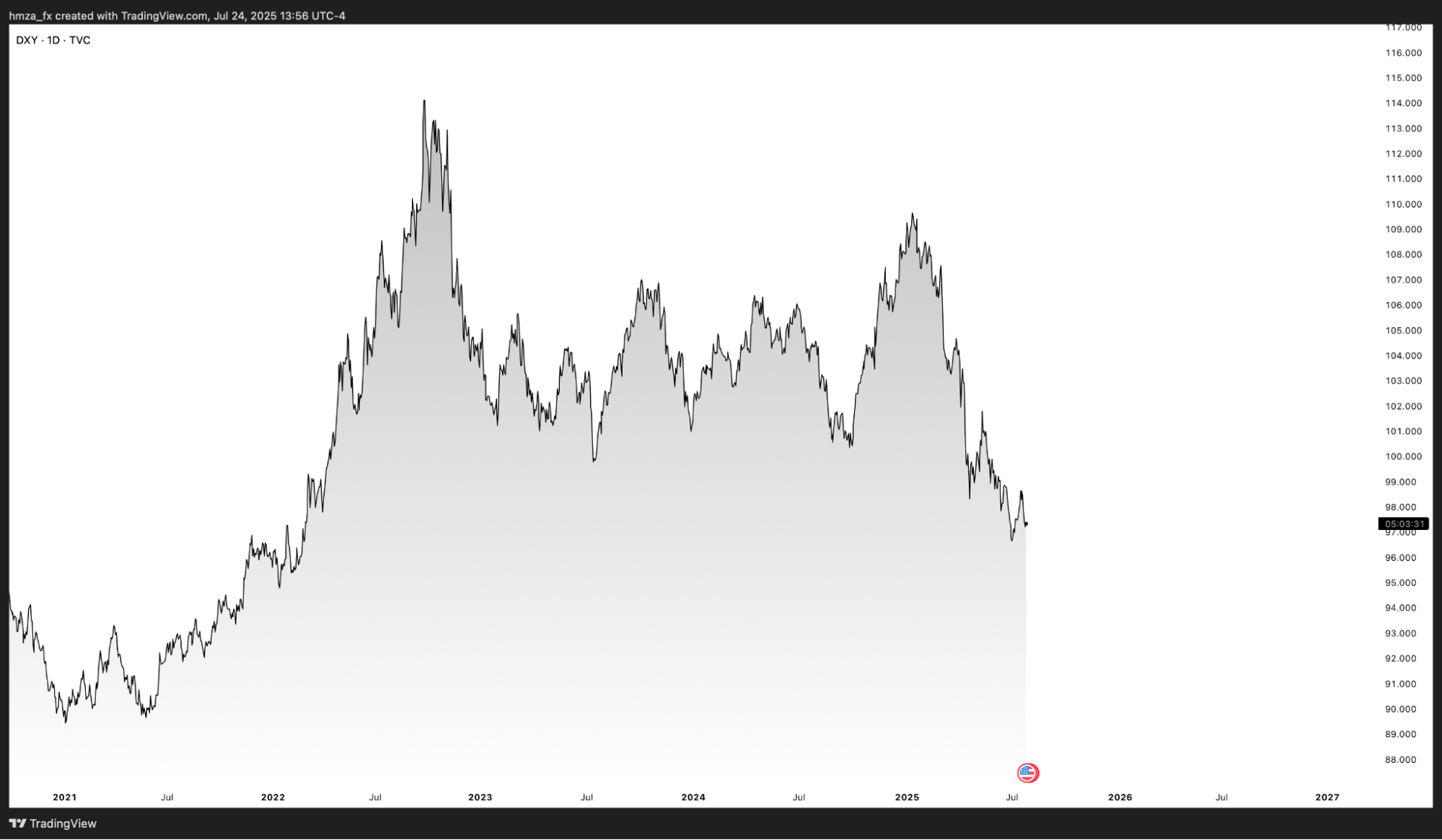

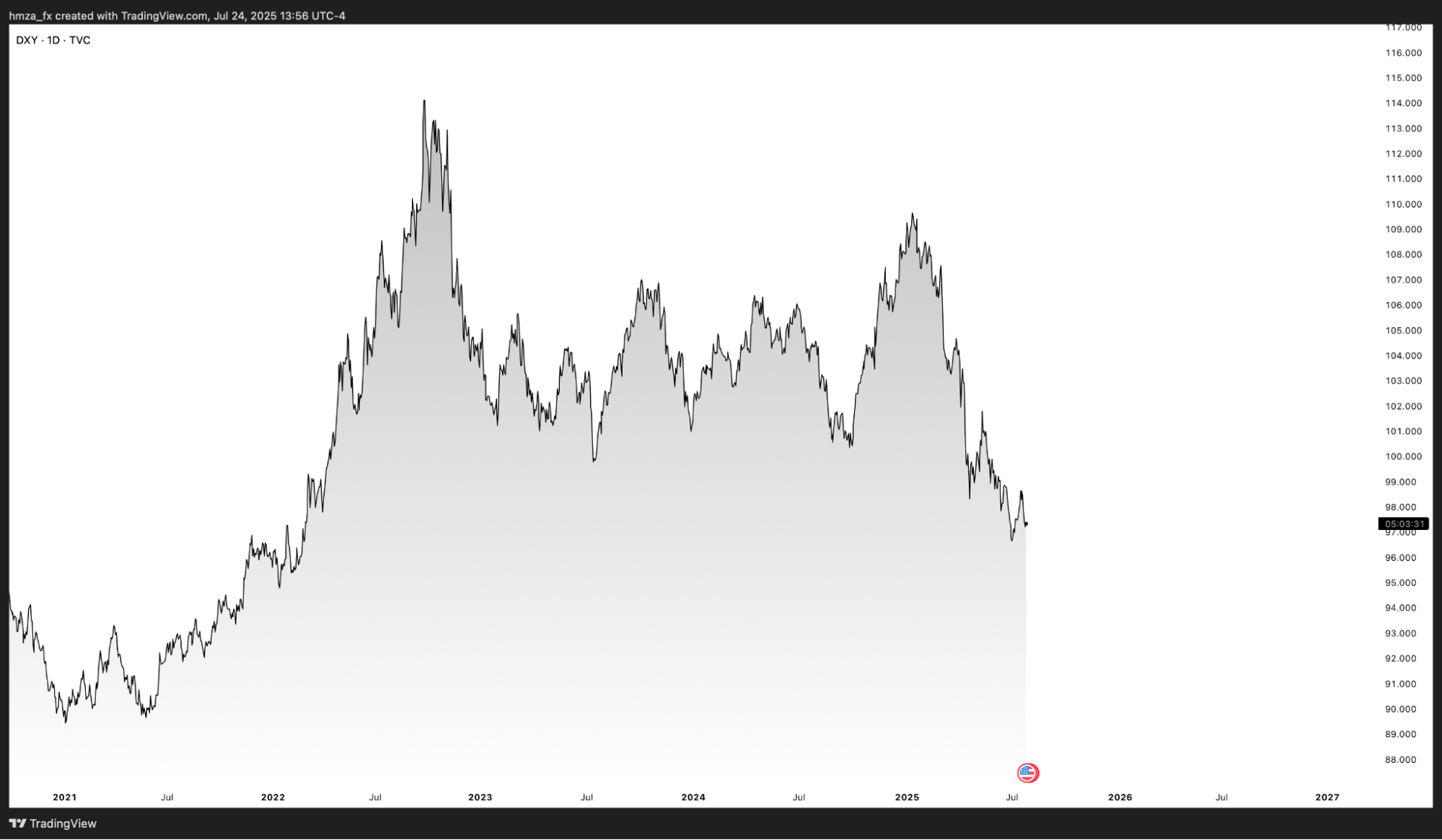

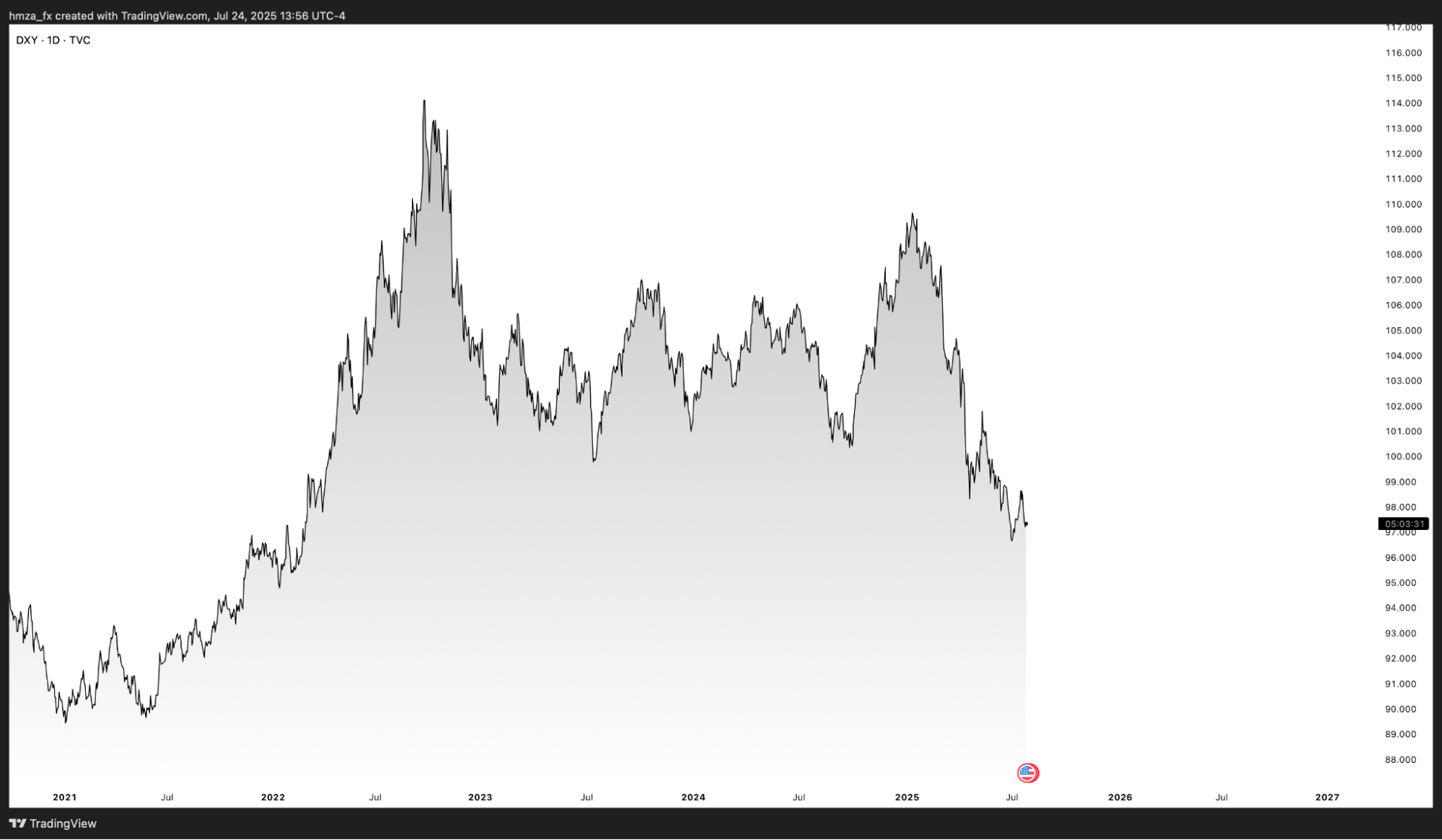

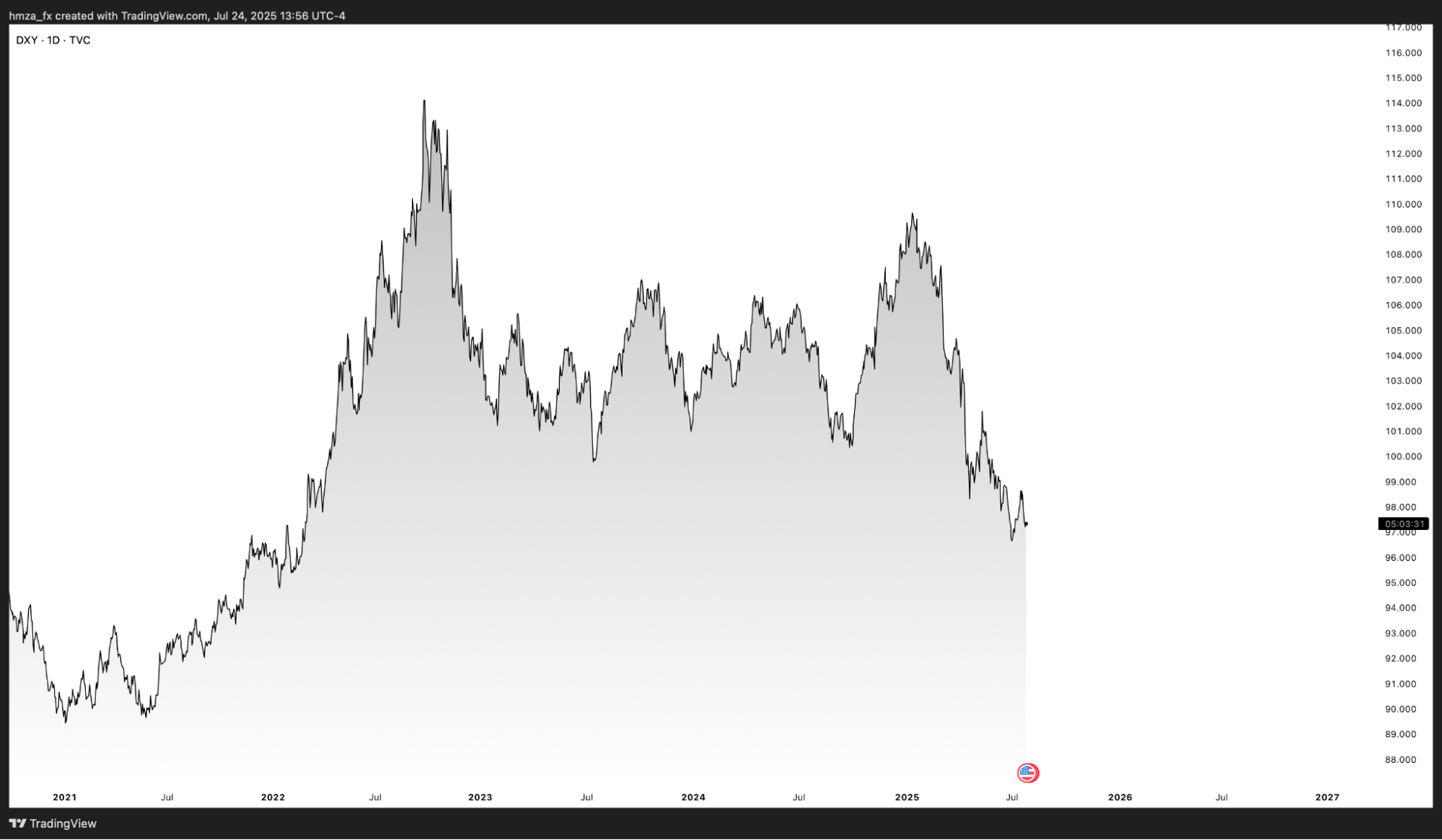

In short, the surrounding environment for commodities remains unclear. The dollar index (DXY) has been range-trading near key support at 90. Positioning is extremely net-short, so a bounce is not out of the question. If the dollar does get off of this level, gold will face even further headwinds.

Additionally, real yields are facing more stability, and since the Fed has no compelling reason to cut, the cost of carrying asset classes (such as gold which does not yield) is quite high. Treasury volumes picked up as well - the FICC cleared a record $11.8 trillion in U.S. Treasuries in June, indicating a sharp demand for duration.

This indicates smart money is defensively positioning - not necessarily risk-off but definitely recalibrating for rate stability. Goldman Sachs continues to be constructive on risk assets and considers gold to be part of the portfolio hedge, but we disagree on the timing. We believe they are underestimating the risk of over-positioning (in gold) at these higher levels.

The difference primarily comes down to this: Goldman views gold as a hedge; we view it as a crowded trade. When everyone is long a hedge, who is left to buy it when the volatility hits?

The credit markets depict a similar story. IG spreads are hovering around historical tights, which suggests complacency. New issuance is being bought with almost no concession, but duration risk is badly underappreciated. If inflation ticks up again or the Fed flexes its hawkish posture again, both gold and bonds could be sold off together.

It depends on your timeframe. In the short term, yes – it is losing momentum, offers are getting filled, but no conviction can be derived from that. The tighter the range, the bigger the warning. However, structurally, gold still has a part to play if inflation surprises or if the Fed pivots too late. Just don't chase it. Be tactical and be conscious of the most important zones: $3,280 as the mental soft floor, $3,500 as stiff resistance. If we cleanly break on volume, great, jump on. But we would rather be a bidder in silver and platinum right now than in gold.

In a market like this, everything depends on timing - and gold is not the only game in town.